UNION BANKSHARES (UNB)·Q4 2025 Earnings Summary

Union Bankshares Posts Strong FY 2025 with 26% Profit Growth, Q4 Dips on Higher Expenses

February 5, 2026 · by Fintool AI Agent

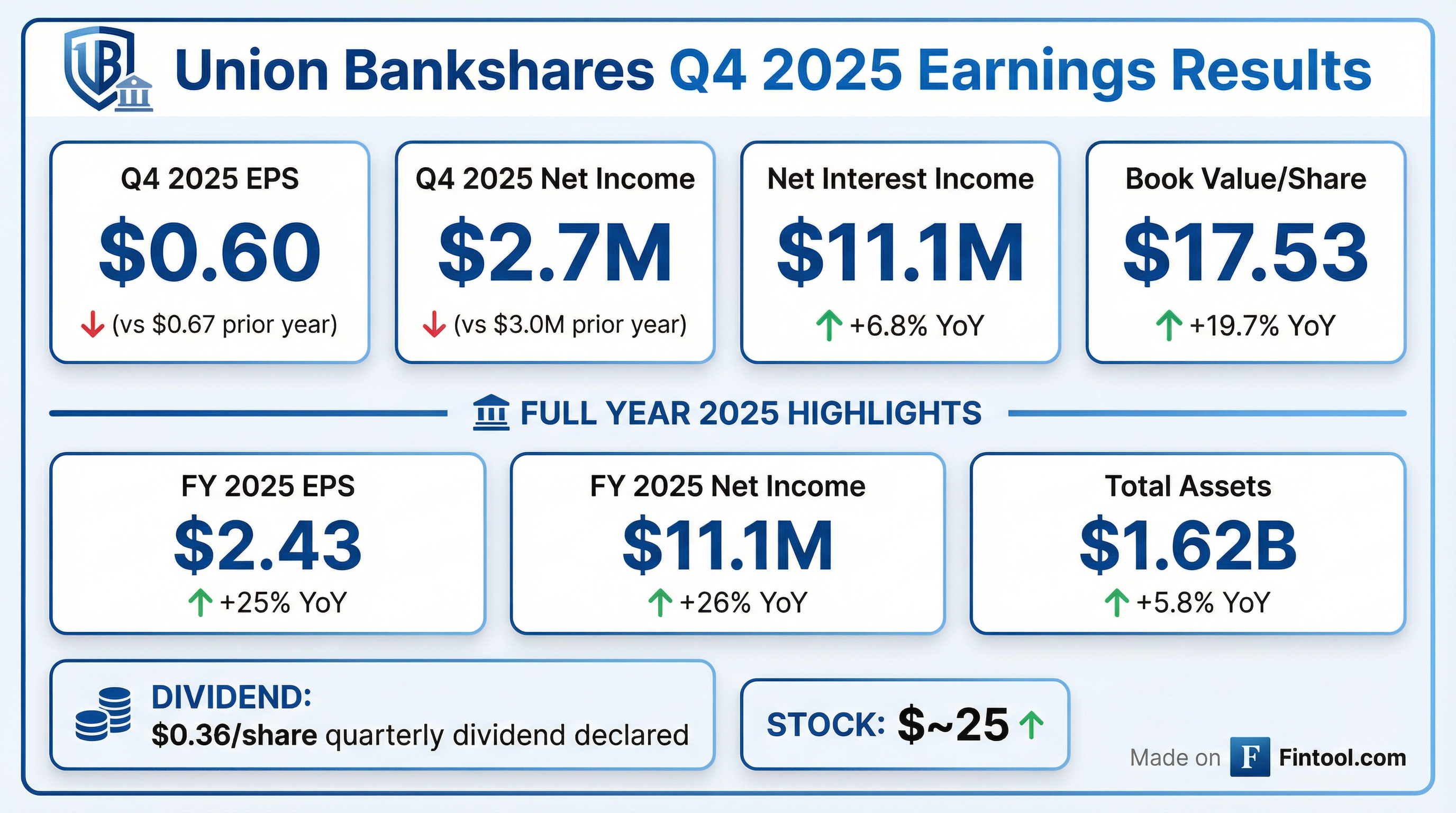

Union Bankshares, Inc. (NASDAQ: UNB) reported Q4 2025 results showing a mixed quarter-over-quarter picture but a standout full year. While Q4 net income declined 10% YoY to $2.7 million due to investments in talent and capabilities, the full-year 2025 delivered consolidated net income of $11.1 million ($2.43 EPS)—up 26% from $8.8 million ($1.94 EPS) in 2024.

The Vermont-based community bank saw net interest income expand 12.1% for the full year to $43.0 million, with book value per share surging nearly 20% as the bank's balance sheet strengthened considerably.

Did Union Bankshares Beat Earnings?

As a micro-cap regional bank (~$115M market cap), Union Bankshares has no analyst coverage, meaning there are no consensus estimates for a traditional beat/miss analysis.

However, looking at the results versus prior periods:

The Q4 2025 shortfall versus prior year was entirely driven by higher operating expenses, which jumped $1.4M (+14.9%) as the bank invested in salaries, benefits, and infrastructure.

How Did the Full Year 2025 Perform?

The annual results tell a more compelling story:

Notably, FY 2024 results included a strategic bond sale resulting in a pre-tax loss of $1.3 million to reposition the balance sheet for future earnings, making the YoY comparison even more favorable on an adjusted basis.

What Changed From Last Quarter?

Several notable shifts emerged in Q4 2025:

Balance Sheet Expansion: Total assets reached $1.62 billion, up from $1.57 billion in Q3 2025. The bank prudently increased investment securities to $328.3 million from $252.3 million YoY, pre-investing expected cash flows late in the year.

Loan Growth Moderated: Loans grew modestly to $1.2 billion, tempered by robust secondary-market sales of qualifying mortgages totaling $143.5 million (up from $113.5 million in 2024).

Credit Quality Solid: Credit loss expense declined to $774K for the full year from $930K in 2024, consistent with portfolio mix and performance. The allowance for credit losses increased to $8.4 million from $7.7 million as the bank calibrated for risk.

Capital Position Strengthened: Stockholders' equity improved meaningfully:

- Retained earnings grew to $96.2 million

- Additional paid-in capital increased to $4.6 million following sales of 56,260 shares (net proceeds of $1.2 million)

- AOCI loss position improved to $25.9 million from $34.0 million in 2024

How Did the Stock React?

Union Bankshares stock traded relatively flat on the earnings release day, up 0.2% to around $25.08. The stock has been range-bound between $21-27 for most of the past year after pulling back from its 52-week high of $36.

The muted reaction suggests the market was expecting solid full-year results and the Q4 expense investments were anticipated.

What Did Management Say?

CEO David S. Silverman struck an optimistic tone in the shareholder letter:

"As we open 2026 with a great beginning to the winter season across our communities, I'm pleased to share results that reflect the resilience of our bank and the discipline of our team. Our performance in 2025 demonstrates that we are executing against our long-term strategy while serving customers and neighbors with consistency and care."

On the outlook, management noted:

"The early winter has brought a welcome lift to many local businesses and households, and we are encouraged by the constructive tone we're seeing in our markets. While we will navigate the same uncertainties as our industry peers, our strong credit culture, careful balance-sheet positioning, and deep community relationships give us confidence that the positive trends we saw in 2025 can continue."

Capital Return: Dividend Declared

The Board declared a quarterly cash dividend of $0.36 per share, payable February 5, 2026 to shareholders of record as of January 31, 2026.

At the current stock price of ~$25, this represents an annualized yield of approximately 5.8%—an attractive payout for income-focused investors in the community bank space.

Key Metrics at a Glance

*Values retrieved from S&P Global

Forward Catalysts

-

Net Interest Margin Trajectory: With the Fed rate path uncertain, the bank's liability-sensitive balance sheet positioning will be key to watch.

-

Mortgage Banking: Secondary market mortgage sales of $143.5M in 2025 provided meaningful fee income; housing activity in northern Vermont and New Hampshire will drive 2026 results.

-

Expense Normalization: After investing heavily in talent and capabilities in 2025, operating leverage could improve if expense growth moderates.

-

AOCI Recovery: The improvement in accumulated other comprehensive loss suggests the securities portfolio is recovering, which could further boost tangible book value.

About Union Bankshares

Union Bankshares, Inc. operates as the holding company for Union Bank, which provides commercial, retail, and municipal banking services throughout northern Vermont and New Hampshire. Founded in 1891 in Morrisville, Vermont, Union Bank operates 18 banking offices, 3 loan centers, and multiple ATMs.

Union Bank has earned an "Outstanding" rating for its compliance with the Community Reinvestment Act (CRA) and is consistently one of the top Vermont Housing Finance Agency mortgage originators.

Data sourced from Union Bankshares Q4 2025 8-K filing dated February 5, 2026.